The IRS recently issued new rules for ethical standards for tax professionals in regard to positions taken on a tax return.

These provisions reside in §10.34 of the Circular 230 regulations that govern ethical standards and discipline for tax practitioners before the IRS. The provisions are separate and apart from similar (and overlapping) rules under IRC Code §6694, which relate to penalties that may be imposed on return preparers under the Internal Revenue Code.

Essentially, there are three courses of conduct that may get a preparer in trouble under the new Circular 230 rules. The same items apply to persons signing a return or claim for refund and persons advising taxpayers on adopting a return position:

a. If the position lacks a reasonable basis;

b. If it is an unreasonable position under Code §6694(a)(2) (relating to the Code penalties on tax preparers); or

c. If the position is a willful attempt to understate liability or is a reckless or intentional disregard of rules and regulations.

Note that it is possible that the position have a reasonable basis, with a violation still occurring. This is because under Code §6694(a)(2), a reasonable basis will not protect a practitioner against penalties for certain tax shelter and listed transaction standards, nor for positions that lack “substantial authority” if required disclosure rules are not complied with.

However, the preamble to the new rules does provide that a violation of Code §6694(a)(2) is not a per se or automatic violation of Circular 230. An independent determination as to whether the practitioner engaged in willful, reckless or grossly incompetent conduct will be made before such a violation is found.

T.D. 9527, IRS Final Regs. Governing Practice Before the Internal Revenue Service (May 31, 2011)

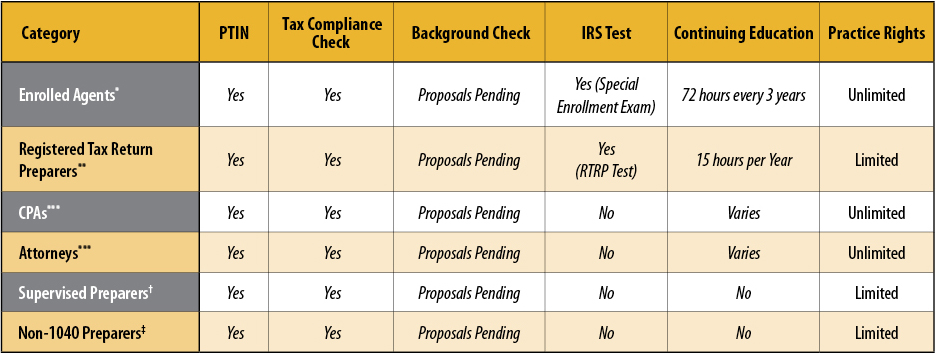

The chart below provides an overview of the various categories of individuals who are governed by Circular 230.

* Enrolled Agents have passed a three-part, comprehensive IRS exam covering individual and business returns. They must adhere to ethical standards and complete 72

hours of continuing education courses every three years. EAs have unlimited practice rights before the IRS, which means they can represent clients for any tax matter.

** RTRPs have passed an IRS test establishing minimal competency. The test covers only individual income tax returns (Form 1040). They must adhere to ethical

standards. They must also complete 15 hours of continuing education each year. RTRPs have limited practice rights before the IRS, which means they can represent

clients in only certain circumstances.

*** CPAs and Attorneys have unlimited practice rights before the IRS.

† Do not sign tax returns but are employed by firms at least 80% owned by attorneys, CPAs or EAs.

‡ Only prepare 1040-PR and 1040-SS and may not identify themselves as registered tax return preparers.

Comments powered by CComment